Swiss Hotels & Chains 2020

By Michaela Wehrle on 01/04/2020

Welcome to the new edition of Swiss Hotels & Chains 2020. Just as we were about to finish preparing this report, COVID-19 made landfall in Europe. In the light of these most recent developments it feels kind of strange to be reporting about the mostly positive developments on the Swiss hotel market in 2019. We will have to wait and see how the global tourism landscape will be transformed through this recent development. As such, this report serves as a pre-COVID status quo, and we hope it can provide a distraction from the overwhelming virus newscasts.

Key Findings

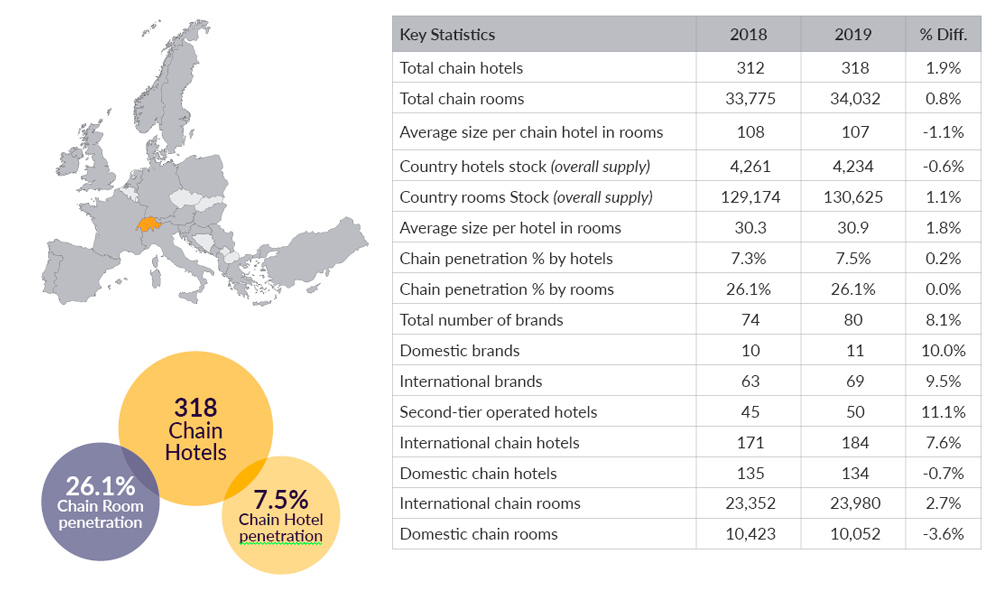

Total Chain Market

The development of Switzerland’s chain hotel market drifts continuously towards economy to midscale properties, where there is still room for growth.

Not surprisingly, the strongest pipelines for the years to come are in Zürich and Geneva. But also Berne Region, ranked third in the pipeline ranking this year, will see 7 new hotels and 857 additional rooms in the near future. Notably, 21% of the new room supply entering the Swiss market 2020/21 will be in Serviced Apartments operations, the majority thereof around Lake Geneva.

Chains

6 new hotel groups made their first appearance on the Swiss hotel market in 2019 while one group completely left the arena this past year. Victoria Jungfrau Collection was reduced to 2 properties only and is no longer considered a group for the purpose of this report.

Overall, we counted 74 hotel groups in Switzerland, including white label operators.

By far the largest group is still and again Accor with nearly unbeatable 73 hotels and 9,350 rooms in stock. That is equal to 23% of all branded hotel supply and 27% of branded room supply in this country.

IHG in second place holds only one quarter of Accor’s total number of rooms.

Brands

Switzerland now counts a total of 80 brands, 6 more than in 2018. Moxy and CitizenM were the most prominently talked about additions. Others were Harry’s Home, Campbell Gray Hotels, and Garden Inn. Swiss Belhotels, Dormero and Vienna House re-branded already existing chain hotels.

In a highly competitive market where land is expensive and construction costs a project killer, hotel owners may be able to achieve a better deal when re-branding. Just so happened to Kempinski, the last Swiss hotel chain with international repute. They lose their home-town property of all things to Fairmont.

Growth

Chain hotel growth has slowed down somewhat in 2019 with 17 hotels entering the market representing 1,492 rooms. Not all of them were new builds, however. We also saw de-brandings and re-brandings taking place. Additionally, some domestic groups adjusted their portfolios while others refined their branding strategies. This is something we expect to see more of in the years to come.

Chains |

|||

|---|---|---|---|

| Rank | Group | Hotels | Rooms |

| 1 | Accor | 73 | 9,250 |

| 2 | IHG | 12 | 2,309 |

| 3 | Marriott | 14 | 2,113 |

| 4 | Radisson Hotel Group | 7 | 1,382 |

| 5 | Sorell Hotels | 18 | 981 |

| 6 | BWH Hotel Group | 14 | 935 |

| 7 | Sunstar Hotels | 9 | 875 |

| 8 | H Hotels | 7 | 799 |

| 9 | Hotels by Fassbind | 7 | 758 |

| 10 | Boas Hotels | 9 | 759 |

The full report Swiss Hotels & Chains 2020 includes an overview of the hotel market in Switzerland and many details about the developments of domestic and international chain hotels in this country.

Have you read the previous reports in this series? Hotels & Chains in Switzerland 2019, Hotels & Chains in Switzerland 2018 and Hotels & Chains in Switzerland 2017.